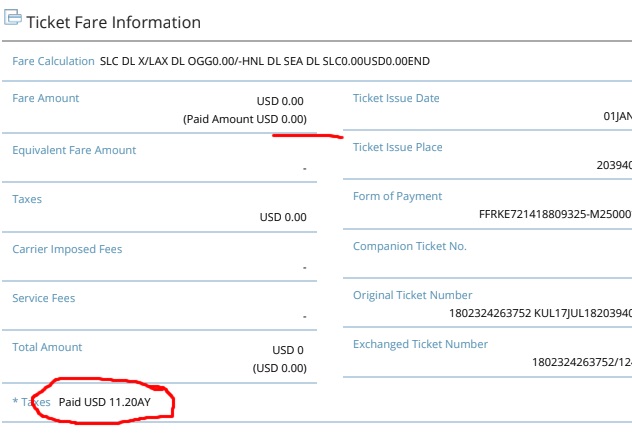

I recently spent 10 days on the beautiful, tropical islands of Hawaii. It was fantastic! Check out my itineraries. The best part was flying to Hawaii cheap. Real cheap. You can’t beat the $11.20 that it cost me to fly from the Mountain West to one of the most coveted vacation spots. Let me share with you the simplest way of travel hacking.

How did I get such cheap airfare? I didn’t cross my fingers while scouring the airline prices for months, or search for unheard-of airlines, or give blood. Anyway, $11.20 was still far cheaper than trying any of those 10 tricks to find a cheap flight you likely heard about. It wasn’t from years of experience either, because this was my first time ever “Travel Hacking”.

What Is Travel Hacking?

I bought the tickets with a generous sign-up bonus from a credit card offer. Just for signing-up and using the card! There are some great cards out there that offer say, a 50,000 point bonus, if you spend so much money with the card in the first x number of months. It was easy for me to accumulate enough points within a few months to book two round trip tickets to Hawaii. I only had to pay cash for the airfare taxes of $11.20 each ticket, $22.40 in total.

It’s simple really. Sign up for credit card, maximize card benefits to earn points, book flight. But let’s walk through exactly what all this entails. It’s fairly easy.

Why Do Credit Card Companies Offer Huge Sign-Up Bonuses?

Most people who get a credit card will end up carrying a balance. Since one pays interest on a credit card balance, the credit card company often makes a lot more money in the long-run. This ends up being very lucrative for them. Companies also entice you with extra perks to sign-up for their credit card over a different credit card company for the same reason- they want their card in your wallet.

If you are diligent about paying your credit card monthly payment in full each month, then you win. You’ll also have the option of closing your credit card account whenever you want. If you don’t pay it off in full each month, then you aren’t really travel hacking. Instead, you’re paying what you would have paid to the airline company (and probably then some) to the credit card company.

Many cards that have really good perks, such as the ones I’ll mention later, have annual membership fees. But, to really entice you to sign up for their card, they usually waive that fee for the first year. This way you can test it out. It’s basically a free trial.

What really made this travel hacking is that I didn’t spend a cent more than I would have otherwise when I was earning the sign-up bonus. Instead of using my usual bank card, I put all of my normal expenses on the new card.

Finding The Right Credit Card For Travel Hacking

To find the right credit card, the two biggest things you will look at are

- What credit cards are offering huge sign-up bonuses?

- What are the minimum spend requirements for that card?

You’ll also want to check the annual fee of the credit card. How much is it? Is it waived for the first year? I have found many that waive the first annual fee but I’ve also seen some that don’t.

Check for what Airlines the credit card company partners with so that you can transfer points. How many points do you need to be able to book flights from your departure area? What flights or airlines are available from your area?

This part might seem like it could get harry trying to work out the logistics. Let’s make it easy. Go to Award Hacker to see exactly what airlines fly from your city, how many points, and where (what credit card program) you can transfer your points from.

I’ll also point you in the right direction below with some reputable companies that have had excellent travel rewards (but keep in mind the top offers periodically do change).

Chase Sapphire Preferred Card

The Chase Sapphire Preferred Card has some great things going for it. If has a generous welcome bonus and the points are easily transferred (from their Ultimate Rewards program, or “UR”) to 12 airline and hotel partners. That gives a lot of flexibility in choosing how to use your points!

It also has a lower annual fee if you want to keep the card open and continue earning points. It offers 2X points when you spend on travel and dining out, plus 1 point per dollar spent on all other purchases.

Another perk of the Utlimate Rewards program is you can purchase airline tickets directly through their online rewards program. You find the flight you want and pay with points. It usually makes more sense to transfer your points to the airline as the points will go further, but you have options and flexibility. If you want to book a flight outside of the rewards availability you can. Plus, you can pay in points and make up the difference in cash if you don’t quite have enough in points.

CITI/ AAdvantage Platinum Select

With the CITI/ AADVANTAGE card you earn points with AAdvantage- American Airlines’ miles program. While this card can be a great way to earn points and it has some good perks (like first checked bag free on domestic American Airlines flights), you’ll want to be sure of your plans to fly with American Airlines since you can’t transfer the points.

Maximizing Bonus Points

Now that you found the right card for you, sign up. You’ll receive the card in the mail and now you have to hit the minimum purchase requirements to get the bonus. Your account start day will be from the day you were approved, not the day you received the card in the mail. Also keep in mind that returns will not be counted toward your minimum spend requirements.

Take advantage of any extra benefits the card offers. Sometimes you’ll get points for adding an authorized user or referring a friend. (Tip: I was able to double dip with my points when I referred my husband, who then applied for the same card. I got 10,000 points for referring a friend, then added him as an authorized user to my card for an additional 10,000 points, plus his 50,000 points when he spent the minimum spend requirement). That won’t always work for every card (and the specific card this worked on is not currently running their refer-a-friend program) but check for opportunities.

Travel Hacking with Points for Hotels

You can also use points for hotels. Points can be a good way to book a swanky hotel but it can take a lot more points- it just depends on the hotel and the point program. Again, look at the reward program through the credit card and see what hotel partners they have.

Conclusion

Travel Hacking with credit card points is an awesome way to take advantage of product offers. But you have to be wise about it. Pay off the full balance each month. Spend carefully and enjoy vacation.

Leave a Reply